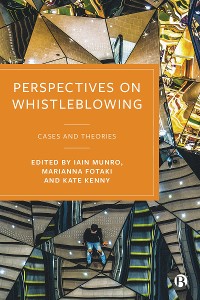

Money, Exchange Rates, and Output

Guillermo A. Calvo

* Affiliatelinks/Werbelinks

Links auf reinlesen.de sind sogenannte Affiliate-Links. Wenn du auf so einen Affiliate-Link klickst und über diesen Link einkaufst, bekommt reinlesen.de von dem betreffenden Online-Shop oder Anbieter eine Provision. Für dich verändert sich der Preis nicht.

Sozialwissenschaften, Recht, Wirtschaft / Wirtschaft

Beschreibung

Guillermo Calvo, who foresaw the financial crisis that followed the devaluation of Mexico's peso, has spent much of his career thinking beyond the conventional wisdom. In a quiet and understated way, Calvo has made seminal contributions to several major research areas in macroeconomics, particularly monetary policy, exchange rates, public debt, and stabilization in Latin America and post-communist countries. Money, Exchange Rates, and Output brings together these contributions in a broad selection of the author's work over the past two decades. There are introductions to each section, and an introduction to the entire collection that outlines the connections throughout and surveys the current state of macroeconomic theory. Calvo, an advocate of the "e;Chicago school"e; of rational expectations, uses elements of this approach to understand economic development. While he is a top macroeconomics theorist, his models are always intertwined with policy discussion. He pushes readers to combine knowledge of real world facts-of institutions, traditions, and culture, in addition to statistics - with theory. One focus of this collection is on the role of credibility in policy-making. Calvo analyzes the origins and macroeconomic consequences of credibility problems. He also shows how monetary and trade theory can fail when the public does not fully believe in policy announcements. A second focus is on equilibrium multiplicity. Calvo uses models with multiple equilibria to identify factors that cause anomalous behavior. He discusses multiple equilibria in abstract terms as well as in terms of its relevance to understanding domestic public debt. Specific issues covered are predetermined exchange rates, currency substitution, domestic public debt and seigniorage, and stabilizing transition economies.